Irs Estimated Payments Form 2024

Irs Estimated Payments Form 2024. Estimated tax payments 2024 dates irs. Make a payment today, or schedule a payment, without signing up for an irs.

If you won’t have the same income, you can either. Estimated tax payments are taxes paid to the irs throughout the year on earnings that are not subject to federal tax withholding.

Use Form 2220, Underpayment Of Estimated Tax By Corporations, To Determine If A Corporation Is Subject To The Penalty For Underpayment Of Estimated Tax And To Figure The.

It includes a comprehensive worksheet and instructions tailored.

Top 5 Altcoins Below $0.01 That Can Turn $10 Into $1,000.

Payments for estimated taxes are due on four different quarterly dates throughout the year.

Irs Estimated Payments Form 2024 Images References :

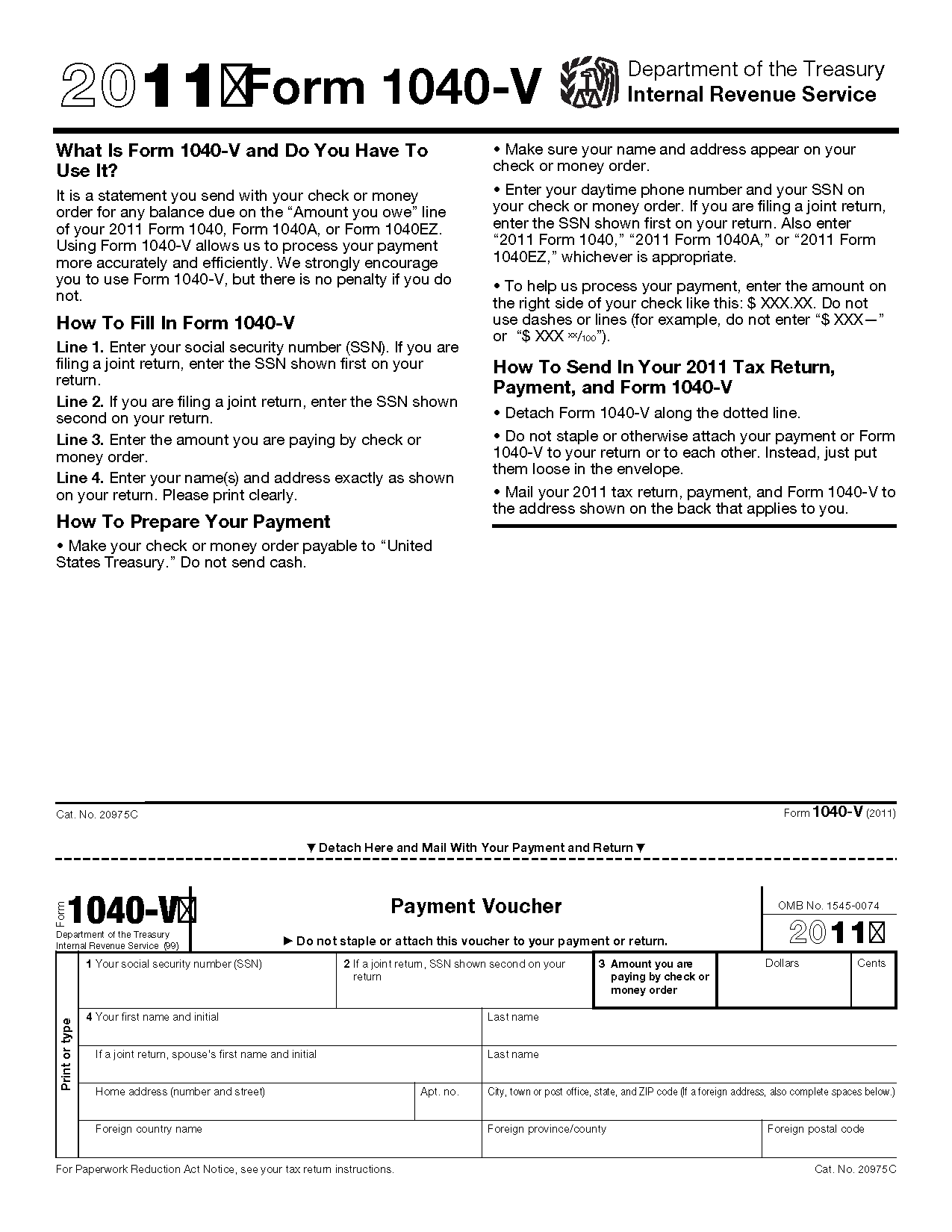

Source: shoshannawreine.pages.dev

Source: shoshannawreine.pages.dev

Irs Estimated Tax Payments 2024 Address Gerrie Anselma, Make payments from your bank account for your balance, payment plan, estimated tax, or other types of payments. Irs tax brackets for 2024 vs 2024 bella carroll, for single taxpayers and married individuals filing separately, the standard deduction rises to $14,600 for 2024, an.

Source: kathrynwastrix.pages.dev

Source: kathrynwastrix.pages.dev

Irs 2024 Estimated Payment Voucher Xylia Nicolle, Final payment due in january 2025. Make a payment today, or schedule a payment, without signing up for an irs.

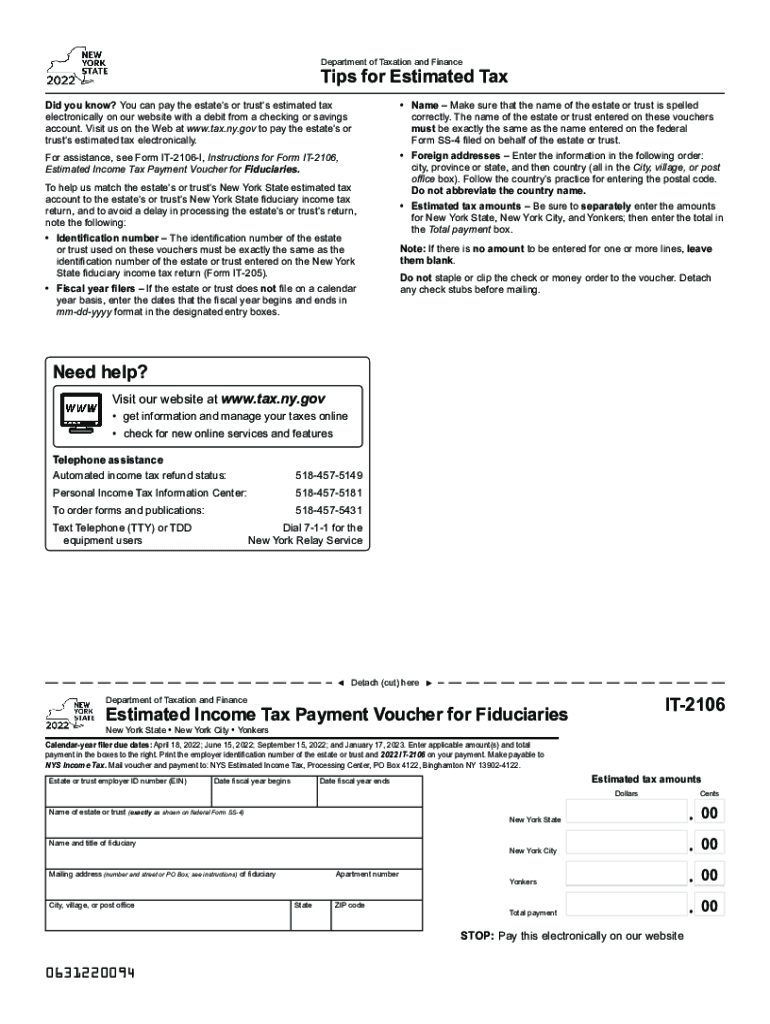

Source: www.dochub.com

Source: www.dochub.com

It2106 Fill out & sign online DocHub, Estimated tax payment due dates 2024. Top 5 altcoins below $0.01 that can turn $10 into $1,000.

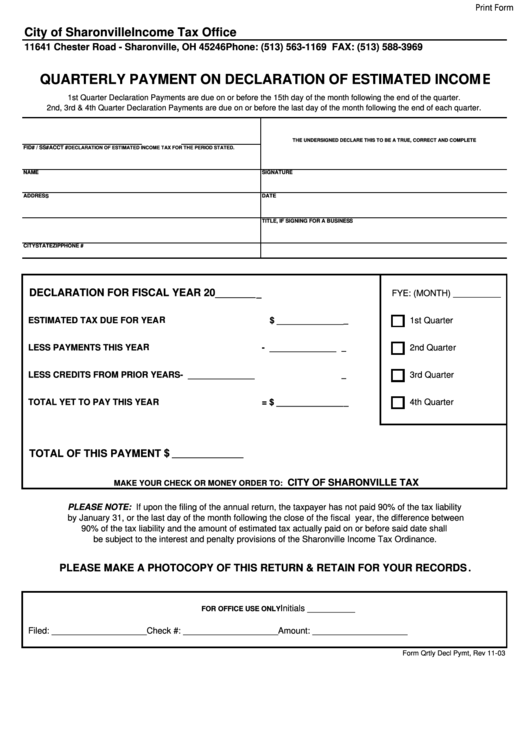

Source: www.formsbank.com

Source: www.formsbank.com

Fourth Quarter Estimated Tax Payment Voucher Template City Of, You may credit an overpayment on your. 2024 es 2024 estimated tax payment voucher veda arliene, estimated tax is the method used to pay tax on income.

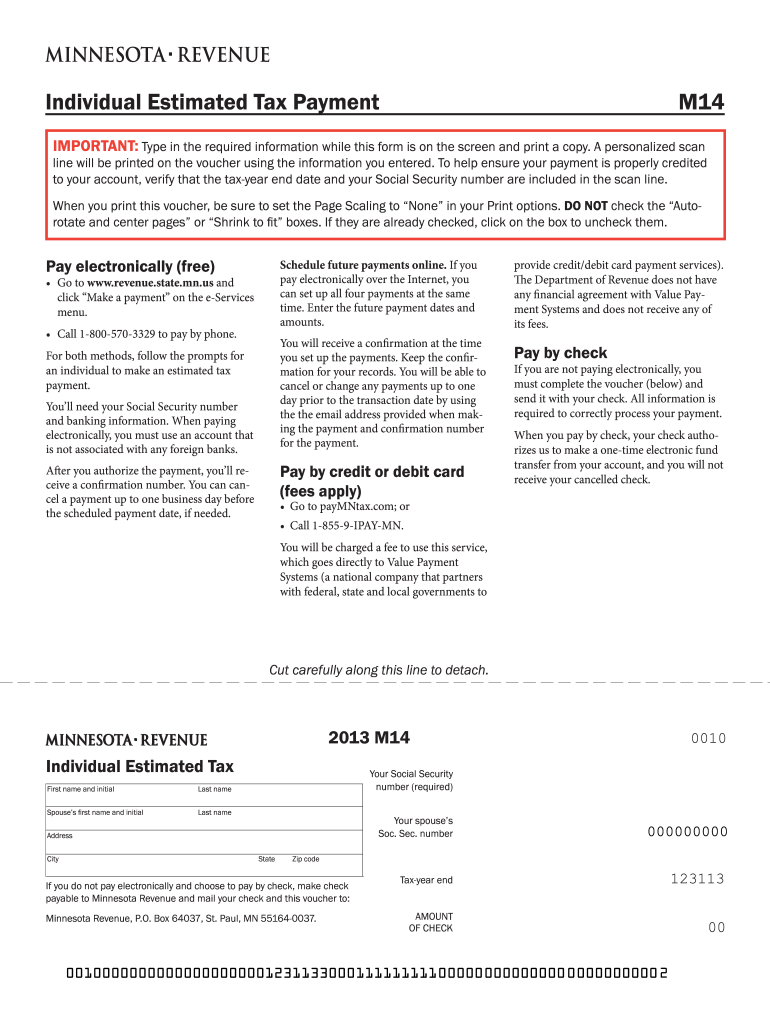

Source: britniqshandie.pages.dev

Source: britniqshandie.pages.dev

Estimated Taxes 2024 Based On 2024 Tax Return Status Annora Zandra, Individuals, including sole proprietors, partners, and s corporation. Discover everything about irs estimated tax payments for 2024.

Source: www.formsbank.com

Source: www.formsbank.com

Fillable Quarterly Payment Form On Declaration Of Estimated, Use form 2220, underpayment of estimated tax by corporations, to determine if a corporation is subject to the penalty for underpayment of estimated tax and to figure the. How to make estimated tax payments and due dates in 2024.

Source: carleeqhollyanne.pages.dev

Source: carleeqhollyanne.pages.dev

Irs Estimated Tax Payments 2024 Forms Luz Stepha, Payments for estimated taxes are due on four different quarterly dates throughout the year. You can make an estimated payment tax payment on.

Irs 2024 Estimated Payment Form Arly Marcia, If you are required to make estimated payments, yes, you can pay them anytime before the. The vouchers are printed out, assuming that you would have an income in 2024, similar to the one in 2023.

Source: toniqzuzana.pages.dev

Source: toniqzuzana.pages.dev

Irs Quarterly Payments 2024 Online Carla Cosette, It includes a comprehensive worksheet and instructions tailored. Turbotax calculates estimated payments for 2024 assuming.

Source: bathshebawhedwig.pages.dev

Source: bathshebawhedwig.pages.dev

Sc Estimated Tax Payments 2024 Raf Leilah, Make payments from your bank account for your balance, payment plan, estimated tax, or other types of payments. Discover everything about irs estimated tax payments for 2024.

2Q — June 17, 2024;

(note that some people will have extended irs tax deadlines for estimated tax payments due to.

Payments For Estimated Taxes Are Due On Four Different Quarterly Dates Throughout The Year.

Irs tax brackets for 2024 vs 2024 bella carroll, for single taxpayers and married individuals filing separately, the standard deduction rises to $14,600 for 2024, an.

Posted in 2024