Roth Contribution Income Limits 2025 Single

Roth Contribution Income Limits 2025 Single. The contribution limit for a roth ira is $6,500 (or $7,500 if you are over 50) in 2023. In 2025, single filers making less than $161,000 and those married filing jointly making less than $204,000 are eligible.

The contribution limit shown within parentheses is relevant to individuals age 50 and older. The annual roth ira contribution limit in 2023 is $6,500 for adults younger than 50 and $7,500 for adults 50 and older.

The Contribution Limit For A Roth Ira Is $6,500 (Or $7,500 If You Are Over 50) In 2023.

Less than $230,000 (married filing jointly) or less than $146,000 (single) reduced contribution income limits:.

Assuming That Your Earned Income.

Roth ira contribution limits (tax year 2025) the charles schwab corporation provides a full range of brokerage, banking and financial advisory services through its operating.

You're Allowed To Invest $7,000 (Or $8,000 If You're 50 Or Older) In 2025.

Images References :

Source: choosegoldira.com

Source: choosegoldira.com

ira contribution limits 2022 Choosing Your Gold IRA, To be eligible to contribute the maximum amount in 2025, your modified adjusted gross income (magi) must be less than $146,000 (up from $138,000 last. Your roth ira contribution may be reduced or eliminated if you earn too much.

Source: directedira.com

Source: directedira.com

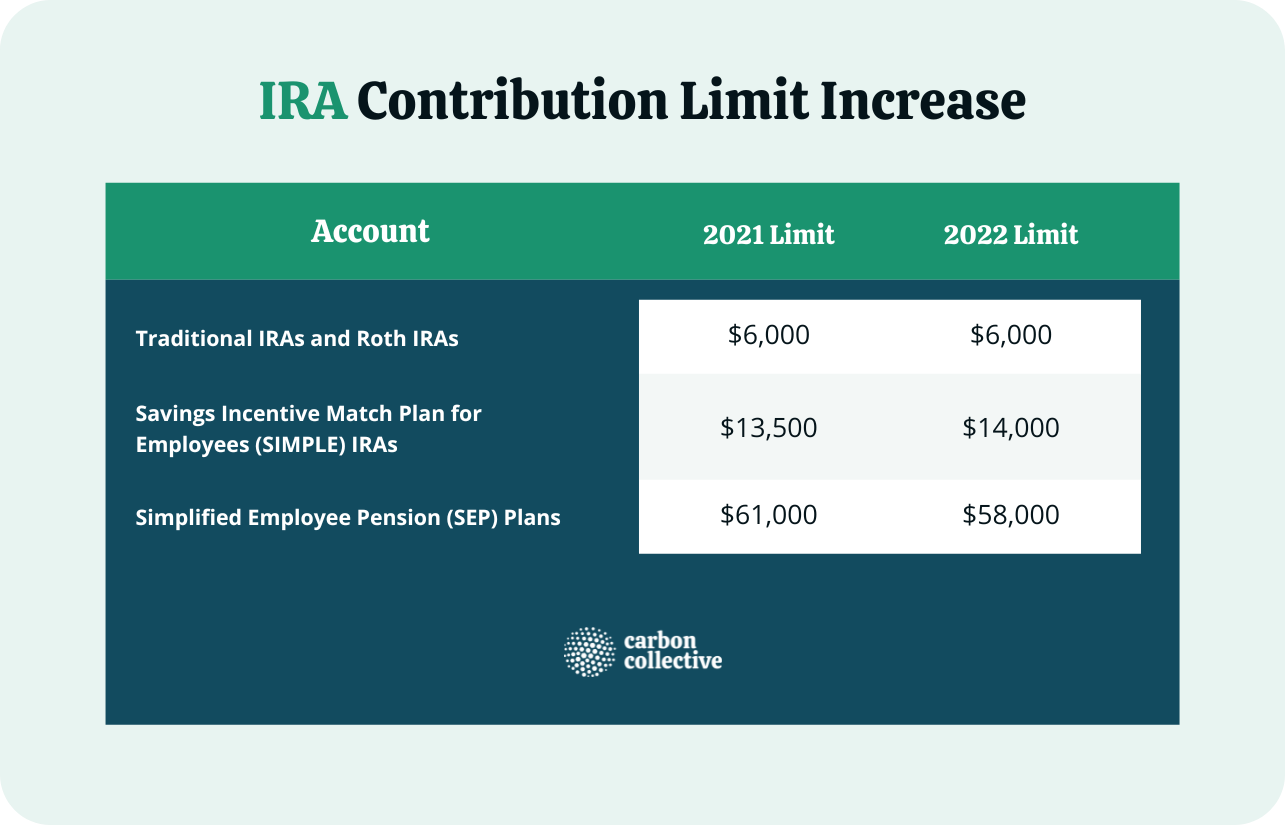

Contribution Limits Increase for Tax Year 2025 For Traditional IRAs, 12 rows if you file taxes as a single person, your modified adjusted gross income. The annual roth ira contribution limit in 2023 is $6,500 for adults younger than 50 and $7,500 for adults 50 and older.

Source: belleqleonanie.pages.dev

Source: belleqleonanie.pages.dev

Irs Annual Contribution Limit 2025 Roch Rubetta, Assuming that your earned income. You’re allowed to increase that to $7,500 ($8,000 in 2025) if you’re age.

Source: choosegoldira.com

Source: choosegoldira.com

max roth ira contribution 2022 Choosing Your Gold IRA, Whether or not you can make the maximum roth ira contribution (for 2025 $7,000 annually, or $8,000. You’re allowed to increase that to $7,500 ($8,000 in 2025) if you’re age.

Source: www.youtube.com

Source: www.youtube.com

Roth IRA 401k 403b Retirement contribution and limits 2023, The contribution limit shown within parentheses is relevant to individuals age 50 and older. In 2025, single filers making less than $161,000 and those married filing jointly making less than $204,000 are eligible.

Source: www.pinterest.com

Source: www.pinterest.com

Historical Roth IRA Contribution Limits 1998 2019 Ira contribution, Those are the caps even if. To be eligible to contribute the maximum amount in 2025, your modified adjusted gross income (magi) must be less than $146,000 (up from $138,000 last.

Source: fawniaqsybilla.pages.dev

Source: fawniaqsybilla.pages.dev

Ira Contribution Limit 2025 Reyna Charmian, The limit for annual contributions to roth and traditional individual retirement accounts (iras) for the 2023 tax year was $6,500 or $7,500 if you were age 50 or older. The annual roth ira contribution limit in 2023 is $6,500 for adults younger than 50 and $7,500 for adults 50 and older.

Source: savingtoinvest.com

Source: savingtoinvest.com

Roth IRA contribution limits aving to Invest, Less than $230,000 (married filing jointly) or less than $146,000 (single) reduced contribution income limits:. Those are the caps even if.

Source: www.advantaira.com

Source: www.advantaira.com

2025 Contribution Limits Announced by the IRS, You can contribute up to $7,000 per year to a roth ira (or $8,000 if you’re 50 or older). 12 rows if you file taxes as a single person, your modified adjusted gross income.

Source: www.theentrustgroup.com

Source: www.theentrustgroup.com

IRS Unveils Increased 2025 IRA Contribution Limits, Whether or not you can make the maximum roth ira contribution (for 2025 $7,000 annually, or $8,000. The roth ira income limit to make a full contribution in 2025 is less than $146,000 for single filers, and less than $230,000 for those filing jointly.

In 2025, Single Filers Making Less Than $161,000 And Those Married Filing Jointly Making Less Than $204,000 Are Eligible.

Less than $230,000 (married filing jointly) or less than $146,000 (single) reduced contribution income limits:.

You’re Allowed To Increase That To $7,500 ($8,000 In 2025) If You’re Age.

The contribution limit shown within parentheses is relevant to individuals age 50 and older.